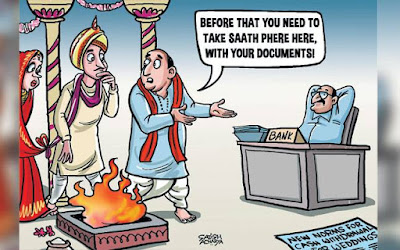

Why Transaction Cost of Demonetisation is Unfair Permanent Tax?

Why Transaction Cost of Demonetisation is Unfair Permanent Tax?

I support demonetisation, but in current form Non-cash Transaction is bad for citizens and government, why citizens are forced to pay 2 to 3 percent more on every transaction by restricting cash supply to ATMs and banks? Many service providers are charging as high as 5% for non-cash transactions incl roadways.

Companies like PayTM is 40% owned by Chinese investors with close link to Chinese government, soon they will have majority stake in many non-cash private companies. Remaining big population of cards are with American companies. We are sharing all banking data with them and non-cash transaction after demonetisation is windfall gain for them. Is this in the spirit of "Make in India"? Is this fair to force citizens to go for these companies without any regulation of transaction charges on various services. This will lead to cartalisation.

They are charging 2 to 3% on every transaction, irrespective of their cost of operation, due to cartalisation. Is Modi policy planned to help Chinese and US companies, because both the governments are working against Indian interest, one in security matters and others are planning to sack Indian employees respectively?

By forcing e-payment on citizens, non-cash companies will charge more than one lakh crores every year on service charges from all the transactions made by consumers of India by e-payment options. This money will go out of country in the name of technology fee, inflated invoices for buying Point of sale machines, software, etc and other charges, plus profit and dividend payments. Will this help Indian economy or will this meet "Make in India" objective?

Please note, this is more than total black money generated in India. Is this sensible policy to go cash-less as of today with existing high charges? Example: On every Rs. One Lakh, as middle class family, you will pay RS. 2000 to Rs.3000 to these companies. This is about Rs. 24,000 to 36,000 per year as service charges only. Late fee and interest charges etc.

Immediately after demonetisation, Paytm’s transactions touched five million in a day regularly and even hit a peak of seven million. In value terms, transaction totals hit Rs 24,000 crore a day. Paytm says that the company has registered a 700 percent increase in overall traffic and 1,000 percent growth in the amount of money added to Paytm wallets. The number of transactions per user increased from 3 per week to 18. But they never told consumers how much they will charge for transactions. This is keeping customers in dark and exploiting political immaturity and policy gap.

Why Mr. Modi is not controlling these charges? What is the motive behind this, when this can be controlled by one office notification.

I propose there should not be any charge more than 0.1 percent on any form of transaction. All banking companies must alos advertise their charges when the promote their services, this should be mandatory under Consumer Protection Act and RBI Act.

Rupay card systems and other e-payment systems of PSU banks and Government of India must not charge more than 0.1 percent from users, rest will fall in line. When PSU banks are making money from other services and charges, why tax citizens more? They should issue Debit cards against Aadhar cards or PAN card to save time.

Moreover, after demonetisation GOI will make huge gain in tax collection, part of that can be used to make e-payments free of cost to consumers.

If you agree, this must be shared to put pressure on government to reduce the charges to not more than 0.1 percent.

Demonetisation is good provided it does not add additional burden on common man. So far, demonetisation is accepted by people, but if hardship continues and additional charges are not reduced, this will force people to rethink about this decision of government, people will go back to cash and e-payment system drive will fail.

Friends, I am not using any e-payment option because these transaction charges are too high for me. These additional charges charges on my month expenditure will be equal to my electricity bill or my monthly LPG bill.

I will use e-payments to make ONLY those payments, where there are no additional service charges for e-transactions. You have to decide how much you want to pay as addition charges.

Demonetisation is good provided it does not add additional burden on common man. So far, demonetisation is accepted by people, but if hardship continues and additional charges are not reduced, this will force people to rethink about this decision of government, people will go back to cash and e-payment system drive will fail.

Friends, I am not using any e-payment option because these transaction charges are too high for me. These additional charges charges on my month expenditure will be equal to my electricity bill or my monthly LPG bill.

I will use e-payments to make ONLY those payments, where there are no additional service charges for e-transactions. You have to decide how much you want to pay as addition charges.

Comments

Post a Comment