How to identify potential wilful defaulters in advance?

How to identify potential wilful defaulters in advance?

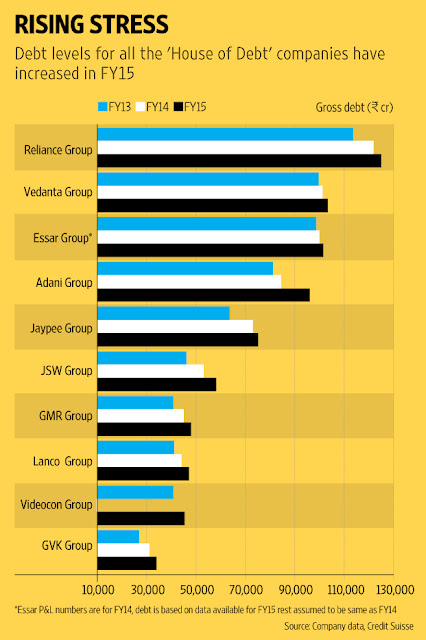

Please see the list below. Read the names very carefully. Are you investing in their shares?

If yes, read their balance sheets carefully, read consolidated balance sheet include all group companies, and read the following columns:

1. Networth

2. Reserves

3. Debt

4. Book value

5. Interest cost

6. Operating Profit

6. Operating Profit

7. Average Operating Margin in the industry

8. Operating profit

9. Net Profit

10. Promoters share (declining or going up and how much is pledged)

10. Promoters share (declining or going up and how much is pledged)

These all are available on website of stock exchanges.

Now how to identify, who will be the wilful defaulter?

Step 1:

The most important question is :

What is the quality of governance in these companies?

In this case please don't go by official records, check with employees of the companies and their suppliers and associates. Ask the following questions:

A. Who are the key office bearers like Chairman, MD, Independent Directors (sometimes these are retired officers from the organisations those were benefiting this company), Chief Financial Officer (what was his role), etc.

B. Are they related to the promoters in any way or in legal terms interested parties / relatives, etc. Please make a list and identify their common roots. Many of them must be related to each other via extended family.

C. Is this company known to be close to the political parties in power or was close to the political party of the previous regime in centre or in the state where they had operations.

D. What was their life style and who was paying for the bills? including private jets, properties at exclusive locations, lavish parties, etc. because generally these can't be funded from personal wealth. Are these going to companies account?

Any Sensible businessman will avoid spending time and money on such activities unless he has multi-location operations in various parts of the world. They are generally not visible in lavish parties because they are business in promoting and managing businesses.

These information you will not find in any annual reports or official document. You have to check this with people around them.

If the answer to these questions are exposing some nexus or relations between these questions, please be clear you are in danger zone.

Step 2:

What is the interest cost and what is the operating profit?

If this ratio is ensuring debt serving is not comfortable from operating profits, you are heading for disaster.

Tip: Check their competitors operating margins in the sector as a whole and think about the ability of the company, under investigation, to pay back loans in the coming days.

If this ratio is not comfortable, you will have wilful defaulter soon.

Step 3:

Do this analysis for all the companies you are interested in?

If common man on the street can find out about governance of the company, what is the problem with authorities and bankers in identifying the nexus between bankers and company management.

Question for the authorities is : What is the competency of the officers investigating these cases in banks and in enforcement agencies. If they are not incompetent or corrupt or both. They will know who is the wilful defaulter.

Follow-up action:

1. Ask them not to leave the country without informing the concerned authorities.

2. Make the list of all properties, including benami properties and ask the banks to do valuation?

3. Use this property as mortgage against the loan by signing revised agreement?

4. If the amount is less than the loan, they are confirmed wilful defaulters.

This is the root question this needs debate on social media. Mainline media will not discuss because most of them are also debt ridden.

Think about it.

Comments

Post a Comment